Further to this, Google is also banning ads for loans with an APR of 36% or higher in the US only. Ads sending you through to products where repayment is due within 60 days of the date of issue are also banned.

(UPDATE: As of the beginning of August 2016, the payday loan ban has still not been implemented by Google. There has been no official word as to why.)

This ban was introduced as research showed to Google that these loans can result in ‘unaffordable payment and high default rates’, which results in users entering a dangerous spiral of unrepayable debt.

So, what does this mean for websites and brands that are relying solely on paid ads to acquire business in this space?

This niche has been one of the most fiercely fought SERPs in recent years, historically dominated by black hat SEOs.

Because of this and the ‘spammy nature’ of queries, payday loans also saw the introduction of its own algorithm in 2013 to help improve the results provided by Google.

To analyse the paid space, we have a proprietary tool called Market Defender which assesses current bidding strategy based on positions/impression share and outputs your ‘digital market share’ based on total volume of available impressions from the keyword/s positions.

Below shows the share of voice within the paid payday loan space:

By directly comparing this against the best-performing websites in the payday loan organic search niche, we’re able to then begin our analysis.

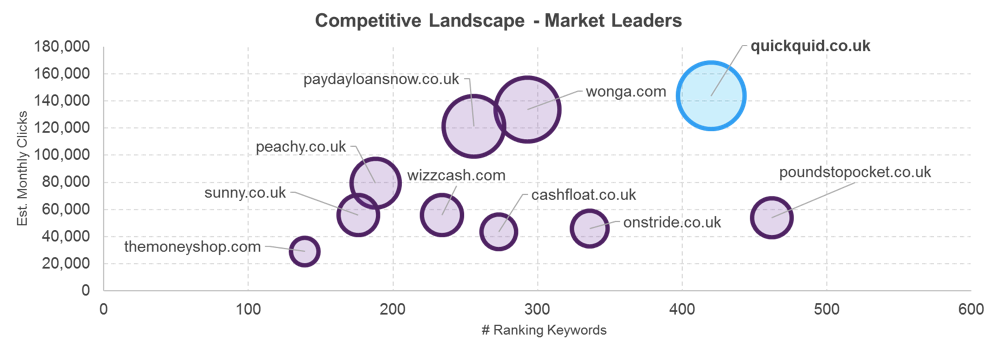

To do this analysis, we’ve compiled 508 of the most competitive keywords within the space that has an estimated return of 403,857 visits if you were to rank first for each individual term.

We have removed all aggregator websites such as uSwitch to focus purely on the lenders themselves.

The chart below shows who these websites are:

Broken down, we can see how each of the top performing websites in organic search is doing:

Now by overlaying the top performing websites in paid with organic, we’re able to identify how the best performing paid websites do in both channels:

You can quickly identify that 11 of the 20 websites do not have over 100 visibility in organic search.

This has to be a huge concern for these websites once Google’s new policy eventually comes into place.

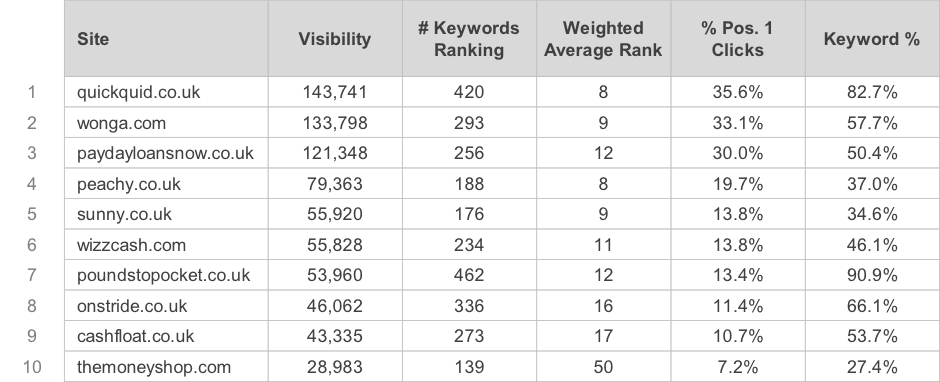

Looking at two important organic metrics – domain authority and number of referring domains – we can dive a little deeper into how these websites stand up to one another.

The top 10 paid websites’ authority and number of referring domains can be seen below:

From this research it’s clear that quickquid.co.uk has had both paid and organic sewn up.

In organic, the site doesn’t have the highest authority, but does have the highest number of referring domains.

QuickQuid is close to being the market leader in paid and is the clear market leader in organic search, so let’s look at which bits it’s doing well.

Analysis of QuickQuid’s performance

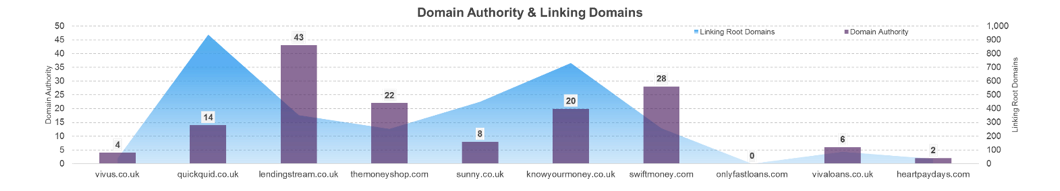

QuickQuid’s link acquisition strategy is working well with links from websites such as inhabitant.com, lifehacker.com, lifehack.org, buzzfeed.com etc.

It’s generally assumed that distributing content about payday loans is difficult, but with the right strategy it can be simple.

QuickQuid isn’t limiting itself to payday lending, but day-to-day facts people are interested in, which is shareable and, most importantly, linkable!

The method QuickQuid has most often utilised is infographic creation on topics that have huge human interest; lifestyle and the environment.

An infographic on ‘Could the entire world really run on solar power’ appears to have done very well – its placement on inhabitant.com acquired 9,900 Likes alone on Facebook, as well as 31 referring domains into the placement, which in turn links through to QuickQuid.

Another infographic on ‘How to create a spa day at home’ was included in a Buzzfeed article on making yourself a happier person.

Lastly, there’s an infographic on ‘How many calories can you burn in 10 minutes’, which has been placed on lifehack.org and attracted 273 shares.

Looking through the ‘Quid Corner’ blog, you’re able to quickly see that this is the company’s main method of content creation and link acquisition.

This method is working in an impressive manner and is helping lift QuickQuid’s website in a difficult niche.

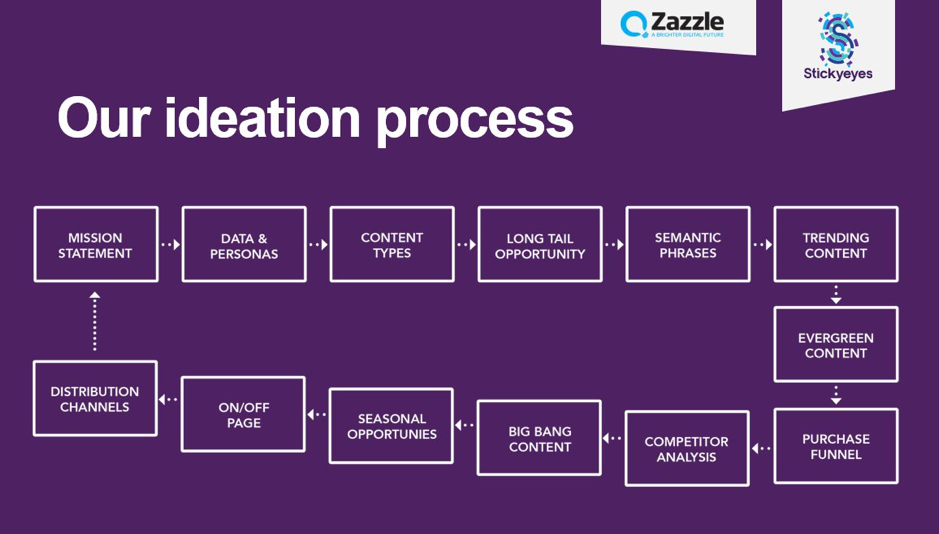

Following on from what is clearly working for QuickQuid, I ran a mini ideation session to better understand how the content strategy might work for QuickQuid.

This is a rundown of our ideation:

Content ideas

Instead of veering too left field, we’ve tried keeping our ideas related to finance in some capacity.

Below are the ideas, as well as content types we created.

Content campaign plan

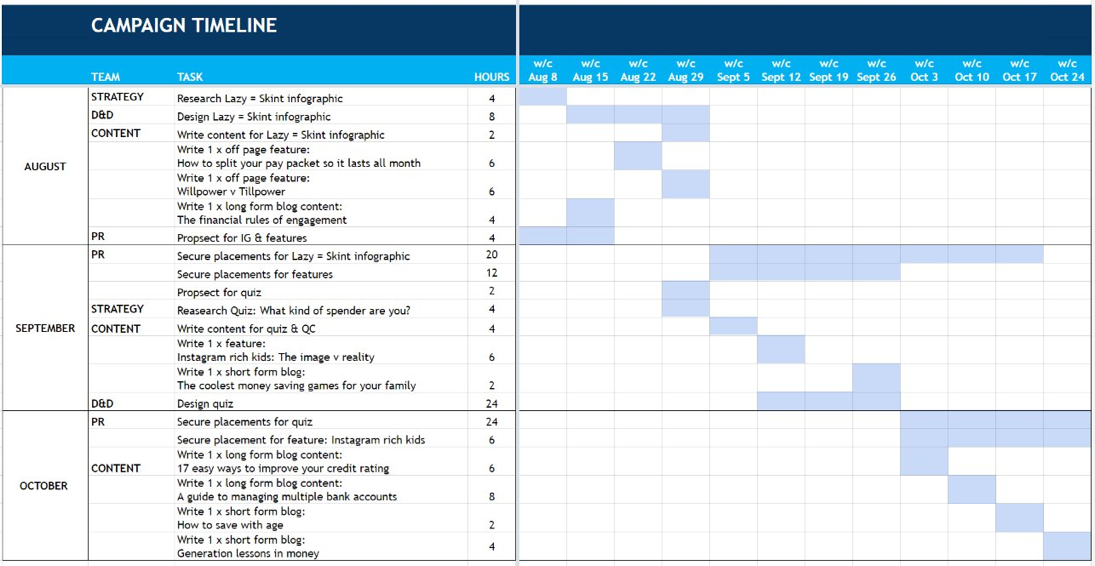

Below shows a potential content distribution plan that would take place over three months. It shows the different teams required to make it happen, as well as ensuring good content flow is achieved.

Constantly posting infographics may become tiring for your audience, so it’s important to mix up the content formats. This varies from short form blogs to quizzes.

In summary…

The analysis shows that 12 of the 20 websites are going to massively struggle once the ban is in place due to having next to zero visibility in organic search.

If it was a quick method of making money via paid acquisition, that’s fine, but if these websites want longevity, they’re going to have to begin looking at an organic strategy, and fast.

Comments