Overall e-commerce popularity in the region

Recent research from Ipsos looks at e-commerce in the UAE, Kuwait, KSA, Lebanon and Egypt.

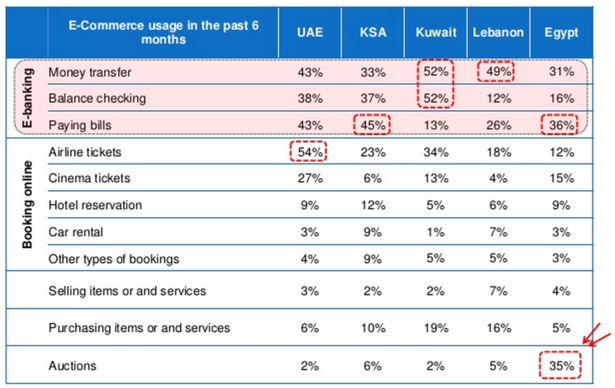

While the actual purchase of items is seemingly low in markets where penetration is highest, making bookings online (for things like airline tickets) are proving popular in the UAE and Kuwait, and the popularity of e-banking throughout these countries signals increasing trust with money-handling online and ample opportunity for growth.

Currently, clothing is the most popular product bought online in the UAE (24%), Kuwait (63%), KSA (14%), Lebanon (38%) and Egypt (69%).

Marketplace-style sites, including Amazon and Alibaba are popular with consumers on the look-out for the latest bargains in fashion and other popular products.

Popularity of domestic commerce sites

While global names such as Ebay (35% of Egyptian online shoppers use auction sites and it is also the fourth most popular ecommerce site in Jordan!) are certainly visible in the ME region, domestic sites such as Souq.com, Cobone.com and Jumia are often winning out against names we are so used to seeing in the UK and US.

20% of UAE online shoppers go to Souq.com. 10% of Egyptian and 13% of KSA e-consumers also visit the site respectively.

Focusing on Souq.com

Data recently published by Gemius also sees Souq.com holding its own among overall internet giants including Google, Facebook and Wikipedia. In March 2013, more than 800,000 UAE shoppers visited the site.

So what is Souq.com doing so well? Unsurprisingly, the site follows an online marketplace format offering clothing, technology, entertainment products and more.

There are also sub-sites for key shoppers including Souq Fashion, Deal of the Day and the high-end boutique marketplace Sukar. The site also looks like it succeeds in separating out the retail wants and desires specific to selected markets – with a locally-optimised Souq.com available each for the UAE, Egypt, Saudi Arabia, Kuwait and Jordan.

Payment options are also significant within the MENA region, and Souq.com does well to ensure it covers all the bases. Alongside credit card, debit card and PayPal options, customers can also pay cash on delivery (giving them the opportunity to ensure the product is what they wanted before paying).

Additionally, they can also use CashU – an Arabic focused pre-pay/mobile payment service.

With a wider variety of payment options from sites such as Souq.com and the online banking sector’s success at getting many consumers to trust dealing with their money online, we are likely to see some significant ecommerce growth across the MENA region in 2013.

Domestic sites with an inherent knowledge of the subtleties and differences between shoppers from different markets look well to capitalise on this, but it will be interesting to see if the favour for US/global internet brands may also be able to help keep Ebay and Amazon in the minds of online shoppers spending their money online for the first time.

The

The

Comments