That’s because last week, Venmo informed its users via email that it’s deprecating functionality on its website, starting with the ability to send and request payments. The email stated:

Venmo has decided to phase out some of the functionality on the Venmo.com website over the coming months. We are beginning to discontinue the ability to pay and charge someone on the Venmo.com website, and over time, you may see less functionality on the website – this is just the start. We therefore have updated our user agreement to reflect that the use of Venmo on the Venmo.com website may be limited.

In a statement to TechCrunch, Venmo further explained:

Venmo continuously evaluates our products and services to ensure we are delivering our users the best experience. We have decided to begin to discontinue the ability to pay and charge someone on the Venmo.com website. Most of our users pay and request money using the Venmo app, so we’re focusing our efforts there.

Although the usage of the Venmo app might be significantly higher than that of its website, some Venmo users took to social media to voice their displeasure with the decision, with some even going so far as to claim that they would no longer use Venmo as a result of the decision.

I don’t know which @MNDarkClouds decided to use Venmo as the app to collect funds for the Charity Club, but it sucks. I can’t pay from the website?!?!? I am required to install an app? And it’s owned by PayPal but not tied to my PayPal account? Why is this so stupid???

— Dave DuJour (@davedujour) May 18, 2018

While Venmo told TechCrunch that “users can continue to use the mobile app for their pay and charge transactions and can still use the website for cashing out Venmo balances, settings and statements,” its email to users directly hints that more functionality will be deprecated in the future, raising the possibility that users who rely on or prefer using the Venmo website could be further alienated.

So what gives? Why is Venmo suddenly making big changes to its service?

The Zelle factor

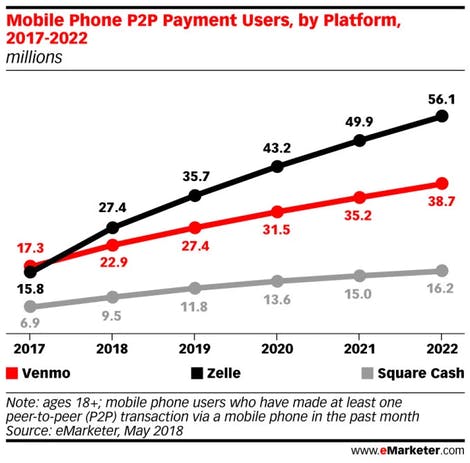

Venmo’s decision to remove website functionality in favor of focusing on its mobile app experience comes at an interesting time. That’s because Zelle, big banking’s P2P payments app, is growing like a weed. In fact, according to eMarketer, thanks to the fact that the more than 30 banks behind it have so many customers, Zelle will overtake Venmo in users this year.

And by 2022, eMarketer expects that Zelle will have a wide lead over Venmo in users, with 56.1m compared to 38.7m, respectively.

While past statements from Zelle representatives indicate that it isn’t trying to compete head-on with Venmo, there is no doubt some overlap between Zelle’s user base and Venmo’s user base and Venmo should probably be somewhat concerned about Zelle’s ability to parlay ubiquity into usage.

With that in mind, the question for Venmo is whether it can afford to take away functionality that a minority of its users use without ill-effect.

On one hand, it would seem that allowing users to pay via the Venmo website is such a basic piece of functionality that there’s really no need to risk removing it. On the other hand, as Venmo looks to solidify its relationship with users and innovate on the functionality and experiences it offers them, being able to focus exclusively on one application – and the one most of its users use – could prove advantageous.

Time will ultimately tell whether or not Venmo’s decision was a wise one, but already, Zelle has proven that big banks can catch up to upstarts like Venmo and once they do, those upstarts will have to become a lot more strategic if they don’t want to find themselves playing catch-up.

Comments