Just 136 days after its initial alpha launch, the public beta for the Mondo banking app launched on 17 March.

It launched with an iOS-only app – I’ve been informed the Android version is on its way.

Having registered for the app I was immediately put in a queue to wait for my card.

Mondo has cleverly incentivised this process by giving each applicant a unique referral link. Every person that subsequently signed up to Mondo off the back of my link enabled me to jump up the queue a few places.

My 170 Equator colleagues did me proud and thanks to them I went from position 23,000 to one in under half an hour!

Once I reached the top it took 12 hours for the app to activate itself and that’s when I was allowed to add funds.

However, rather than using scanning technology for ID, such as passports, driver’s licence , etc. as I thought it might, the app took my details in a traditional fashion. The flash of innovation came in the final stage of setup.

In order to open a Mondo account, I would have to transfer a minimum of £100.

Though I could have done the transfer manually using my Santander app, instead Apple Pay enabled a seamless bank transfer using only my fingerprint.

Well, 10 seconds later, and I had opened a Mondo account.

After 48-hours, the screen changed to let me register the fact that my card had arrived…

I liked the thick blue envelope and the orangey colour of the card; the sleeve reminded me to protect my number if I did decide to share my adventures in Future Banking.

Which of course I did. (#geek)

And I was in! The simple transaction screen details current balance, the day’s spend and recent transactions.

I have to give it to Mondo. Its app is clever, it’s lean, there’s no messing about, it’s fully functional and needs no further authentication layer to get in.

Once I open the app I can see all my transactions without tapping in another password.

When I buy something with my new Mondo card it’s like any other normal transaction, though at this moment in time it makes use of a Prepay Mastercard debit card.

This means that it does not come with a sort code or account code on the card, but it does have a Pin (which was texted to me) and contactless.

I was most impressed with my purchase history with Mondo – on one occasion when making an online purchase, the Mondo app registered five seconds faster than the confirmation from the online retailer’s site!

And every other transaction has appeared on my phone screen within two to three seconds. Speedy or what?

Also, if Mondo recognises a store it will brand the icon next to the payment, and if it can’t it will categorise the item (e.g. ‘Eating Out’ or ‘Groceries’).

It also lets me add notes and photos to purchases, which give me a fuller picture of my spending activities.

What’s more, I can categorise expenditure. For example, if I classify items as expenses, Mondo can collate these making it easy for me to hand into my boss.

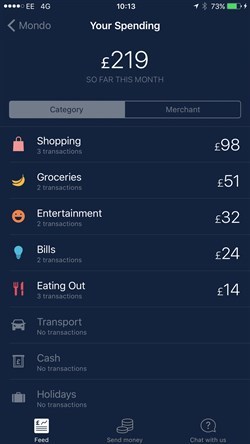

Dig a little deeper and I can see all purchases made over a certain amount, by ‘Merchant’ or by ‘Category’.

And there’s even a handy graph that lets me track spend and income habits as an easy line graph.

Other bits…

Like with other banking apps, you can now send money by text. Nothing too novel there but this bit is all secured by Touch ID.

You can chat to customer service staff at any time through a conversation window, sending images if necessary. They’re pretty fast at getting back too.

They’ll respond through the chat window and through your email.

In conclusion…

Ok, so it’s not a full banking app yet but the platform shows incredible promise.

Mondo has thought long and hard about the user experience, maximising the phone’s power where it can, cutting out paper almost completely (you still need the card) and making the interface incredibly intuitive.

There are still some simple things Mondo could have done to make it even slicker but it may be working on this or may be stymied by financial regulation.

I hope that, in time, it becomes a learning app – learning not just from your own behaviour, but from all users.

I enjoy the wit and humour injected into the app and did not feel that it was inappropriate for a serious banking app.

In terms of performance, the app is very fast, never stalls and purchases come through incredibly quickly.

I think there’s a bright future here. The big banks need to watch this one intently!

For more on this topic, see:

Comments